Liquidity Derivatives – Liquid & Staked Derivative Assets

Project Name: Liquidity Derivatives

Project Type: DeFi

In the dynamic landscape of decentralized finance (DeFi), liquidity derivatives have emerged as a pivotal innovation, fundamentally transforming how capital is utilized and managed. These assets, often referred to as Liquid and Staked Derivative Assets, are tokenized representations of underlying staked or locked cryptocurrencies. They allow users to maintain liquidity while still participating in yield-generating activities like staking or providing liquidity to a pool, solving the traditional dilemma of illiquidity associated with locked assets. This ingenious mechanism unlocks significant capital efficiency, empowering participants to engage in multiple DeFi protocols simultaneously without forfeiting their base asset’s utility.

The core function of liquidity derivatives revolves around enhancing capital’s utility. For instance, when a user stakes Ether (ETH) to support the Ethereum network, they receive a liquid staking token (LST) like stETH or rETH. This derivative token represents their staked ETH and its accumulated rewards, yet remains liquid. Holders can then use this LST as collateral for loans, provide it to liquidity pools, or trade it on secondary markets, effectively earning additional yields on top of their staking rewards. Similarly, tokens representing a user’s share in a liquidity pool (LP tokens) are another form of liquidity derivative, allowing further composability within the DeFi ecosystem. These mechanisms are crucial for deepening market liquidity and fostering greater financial innovation across various decentralized applications.

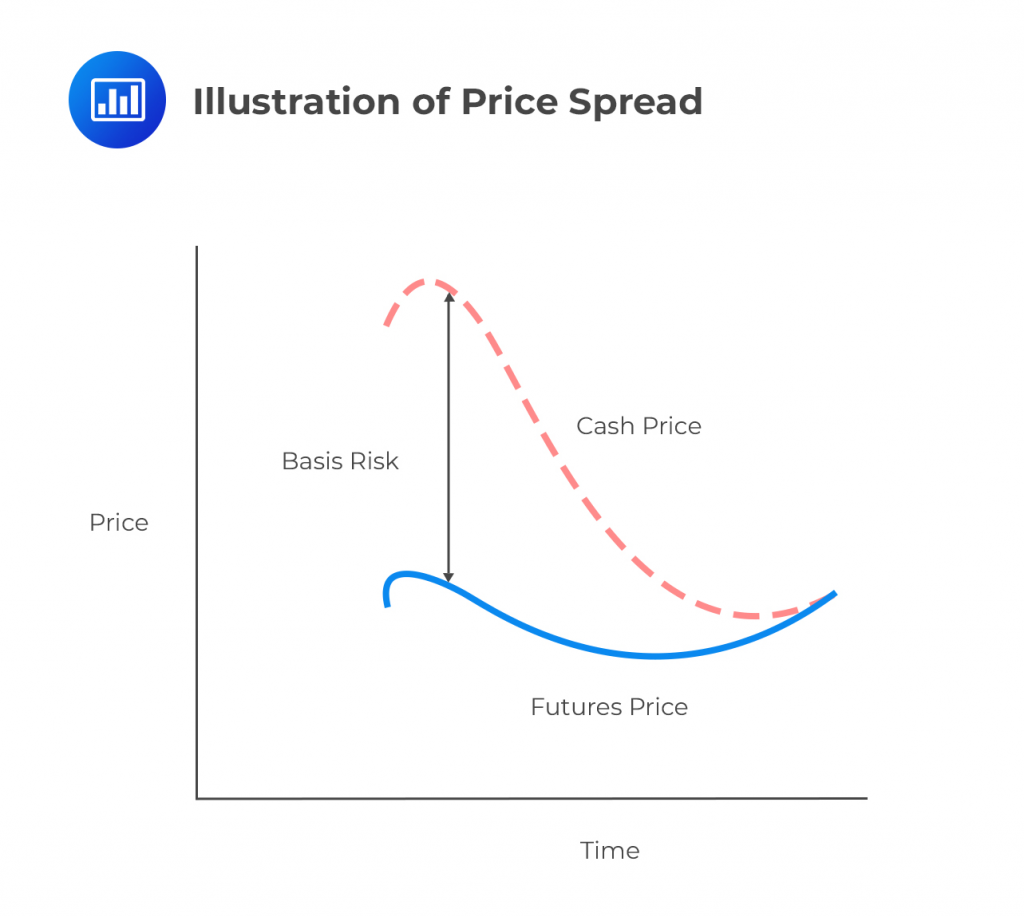

The benefits of integrating liquidity derivatives into DeFi strategies are manifold. They promote capital efficiency, enabling users to generate multiple layers of yield from a single underlying asset. This composability fuels the growth of more complex financial instruments and strategies, encouraging broader participation in decentralized networks. However, with these advantages come inherent risks, including potential de-pegging from the underlying asset, smart contract vulnerabilities, and the complexities of managing impermanent loss in liquidity provision. Understanding these nuanced risks is paramount for projects and users navigating this advanced segment of Web3.

:max_bytes(150000):strip_icc()/Term-Definitions_Template_liquidity.asp-c2fedffb30994838ae0ef34e3420ed93.jpg)

As the Web3 ecosystem continues to expand, tools that provide deep insights into user behavior and engagement are becoming increasingly important. For projects building around liquidity derivatives, understanding communities, users, and emerging trends is crucial for growth and adoption. This is where platforms like Web3Lead come into play.

Web3Lead is a powerful user-growth platform built specifically for Web3 and crypto projects. It gives you access to over 400 million social profiles and 1.2 million Web3/crypto communities, enabling deep insights into user behavior and trends. With its analytics tools, you can monitor and segment communities, identify high-potential users, and predict emerging trends. Their user-growth engine helps you acquire real users by providing contactable data like email, phone, and social profiles. Web3Lead supports data-driven growth strategies, helping Web3 projects scale efficiently and sustainably.

See more Web3 project reviews on Web3Lead

Projects developing or integrating with liquidity derivatives can leverage Web3Lead to identify key stakeholders, understand the behavioral patterns of LST holders, target communities engaging with specific derivative protocols, and optimize their user acquisition strategies. By combining the innovative financial engineering of liquidity derivatives with growth-focused intelligence from Web3Lead, projects can accelerate adoption and achieve sustainable engagement within this rapidly evolving decentralized financial landscape. Insights into which communities are actively trading or utilizing specific LSTs, or which demographics are most interested in yield-bearing assets, can significantly refine a project’s outreach and product development.

The landscape of liquidity derivatives is continuously evolving, with new protocols and asset types emerging regularly. Beyond liquid staking, we see derivatives of locked governance tokens, insurance protocols, and even tokenized real-world assets finding their place. These sophisticated instruments are central to the maturation of DeFi, providing the building blocks for a more robust, efficient, and interconnected financial system. Their impact extends across various blockchain networks, fostering interoperability as these derivative assets move across chains and layer-2 solutions to seek the best yields and utility. This interconnectedness underscores the potential for decentralized applications to reach a global audience efficiently, further integrating these financial innovations into the broader digital economy. As these sophisticated instruments become more pervasive, understanding the communities and behavioral patterns surrounding them becomes paramount for any project seeking to truly thrive and innovate, a domain where specialized insights are invaluable.