Elements of an AI Bubble: Demand Versus Energy Supply

There has been considerable discussion surrounding a potential AI bubble, yet some industry leaders perceive the situation differently. Sundar Pichai, CEO of Alphabet, acknowledged “elements of irrationality” in the current AI infrastructure boom. However, the recent unveiling of Google’s Gemini 3 LLM suggests that the market might not be irrational enough.

Gemini 3 reportedly demonstrated a significant leap in performance over its predecessor, Gemini 2.5, as measured by language model metrics. This development seems to challenge the “scaling wall thesis,” which proposed that large language models had reached a performance plateau where increased computational power no longer yielded substantial improvements. Google’s success with Gemini 3, attributed to improved algorithms, better training, and newer chips, signals a green light for continued intensive investment across the sector.

Nvidia CEO Jensen Huang confirmed that investments in GPUs remain robust, with “Blackwell sales off the charts, and cloud GPUs sold out.” Furthermore, Nvidia CFO Colette Kress highlighted the enduring utility of older hardware, stating that “the A100 GPUs we shipped six years ago are still running at full utilization today.” This comment appeared to directly address Michael Burry’s assertion that Nvidia’s customers might be overstating earnings through unrealistic depreciation schedules.

The longevity of GPUs is supported by a “cascading use model,” where newer chips handle demanding training tasks for a period before transitioning to inference tasks, and eventually to simpler operations like streaming YouTube videos. This extended lifespan suggests that, contrary to some concerns, AI companies might actually be understating their earnings. Despite these positive indicators, stock markets experienced a downturn this week, indicating a potential shift in market focus from chip demand to the more pressing issue of energy supply.

Demand for AI compute capacity is nearing insatiable levels. A Google Cloud executive estimated that capacity would need to double every six months for the next four to five years to keep pace. Yet, the required power infrastructure is a significant bottleneck. Building new gas turbines, which fuel most data centers, takes five to seven years, and manufacturers are fully booked until at least 2030. Without additional power, the incentive to acquire power-intensive, next-generation GPUs diminishes, as older, less demanding chips could suffice or even perform better. Similarly, constructing new data centers becomes moot without available turbines.

This critical energy constraint suggests that the AI bubble could burst, even if the demand for AI itself remains effectively limitless. Pichai also warned that if the AI bubble were to pop, “no company is going to be immune, including us,” a statement that, while referring to AI companies, broadly encompasses a significant portion of the economy. Data centers, accounting for 4% of US GDP, remarkably contributed 93% of GDP growth in the first half of the year, underscoring their vital role in the economy.

Key Market Charts

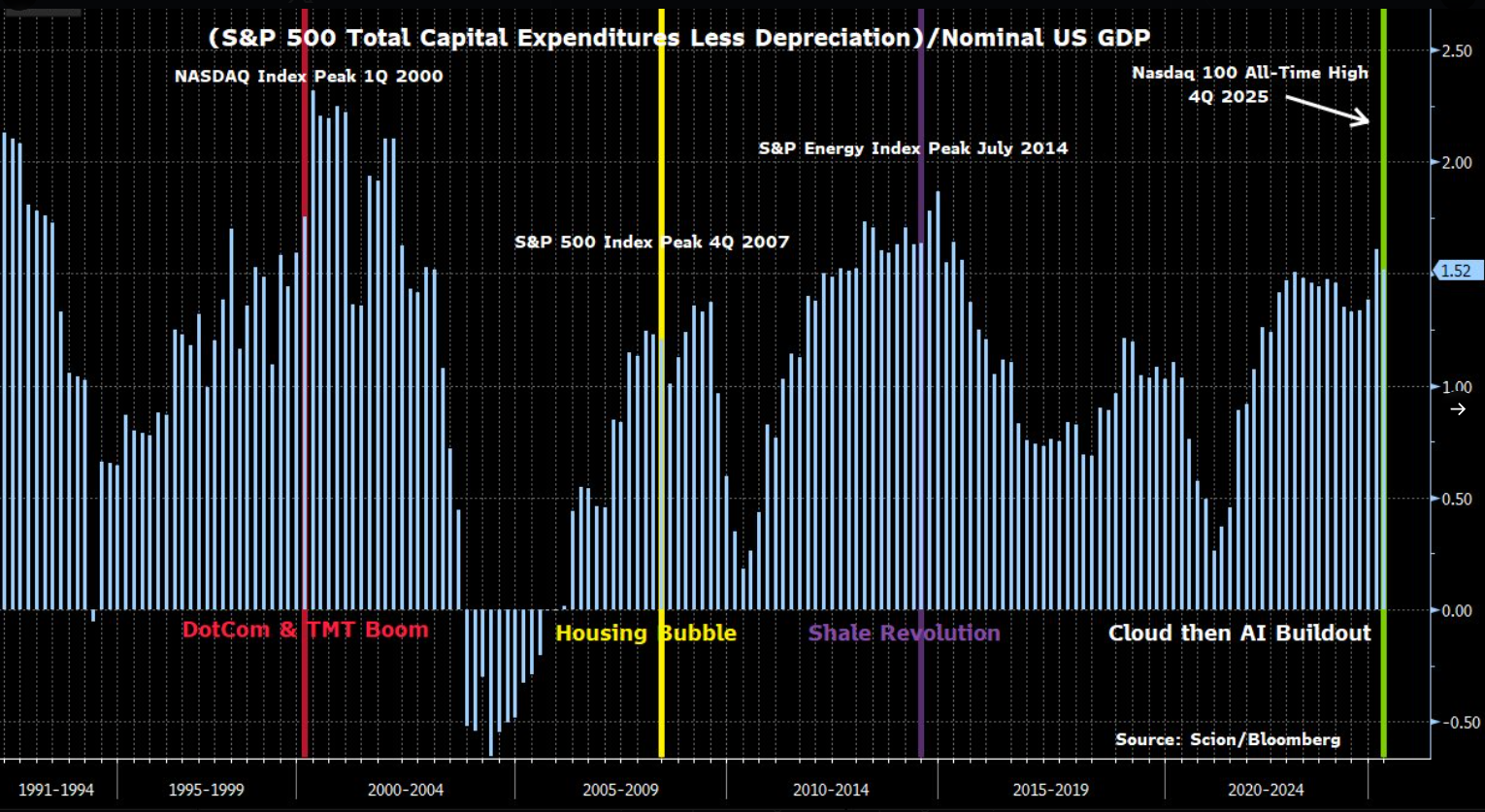

Michael Burry suggests that the following chart is crucial for understanding the current market. Measured as capital expenditure as a percentage of GDP, the AI boom is already comparable in scale to the investment surges that preceded the dotcom, housing, and shale bubbles.

Contrary to Burry’s perspective, notes from a16z highlight that demand for older, less powerful A100 GPUs has remained surprisingly strong, supporting the idea of a cascading use model and prolonged utility.

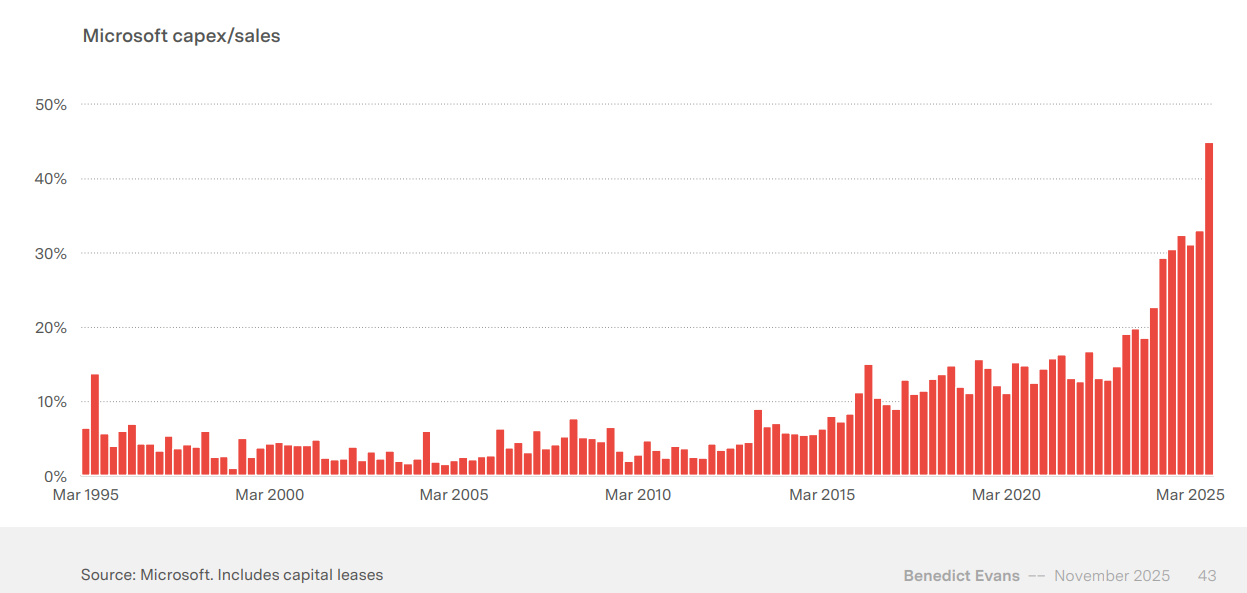

Microsoft’s capital expenditure has surged to nearly 50% of sales. Benedict Evans notes this shift indicates Microsoft’s business model has evolved from competing on network effects to competing on access to capital, a dynamic more susceptible to bubble conditions.

The trend extends to startups, with Benedict Evans observing that nearly all Y Combinator startups are now focused on AI.

Historically, if the current AI trend is indeed a bubble, patterns suggest it could still grow considerably larger before any potential correction.

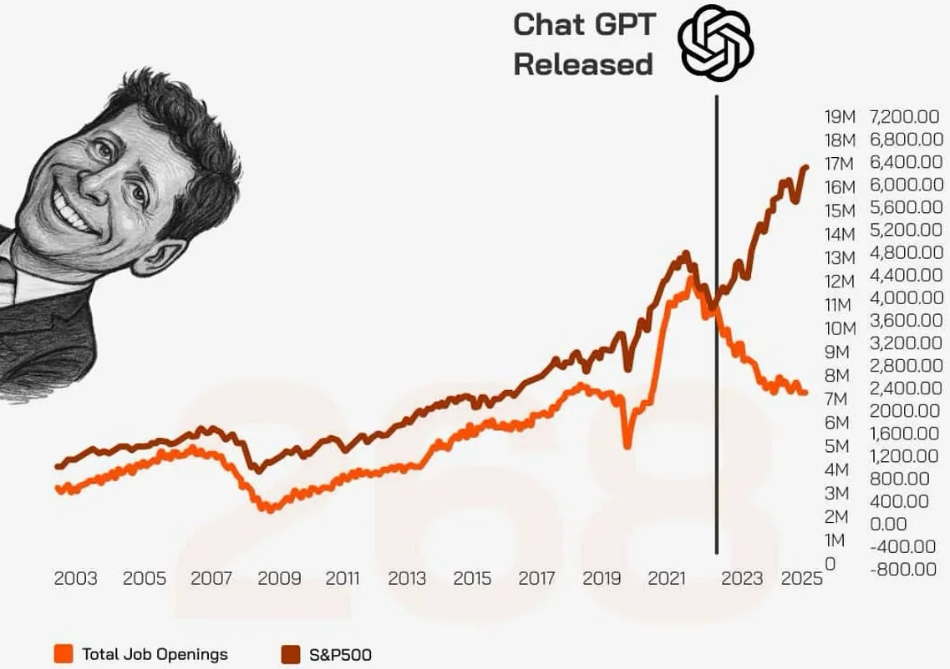

One striking chart from Derek Thompson illustrates the S&P500’s upward trajectory since ChatGPT’s inception, while the number of US job openings has concurrently declined. While causality is uncertain, the correlation is notable.

Regarding employment, Benedict Evans draws a parallel to the “Autotronic” elevator introduced by Otis in 1950, which coincided with the peak employment for elevator attendants. While AI could automate many roles, most elevator attendants in the 1960s found new, often better, employment, suggesting that widespread job displacement might not be the inevitable outcome.

Recent jobs data showed a surprise gain of 119,000 jobs in the US in September, indicating ongoing labor market resilience.

In the housing market, Torsten Slok notes that the median age of US house buyers has risen to 59, reflecting changing demographics and affordability challenges.

A new study on US prices reveals that tariffs have increased the cost of imported goods by 5.44%. Other inflationary observations include the average US car price exceeding $50,000 and, in some areas, gasoline being cheaper than water.