Uniswap V4 – AMM Protocol Upgrade

Project Name: Uniswap V4 (UNI V4)

Launch Date / Mainnet Date: Not yet live (Whitepaper released June 2023, launch date pending)

Founders & Team: Uniswap Labs (Hayden Adams founder of Uniswap)

Investors / Backers: Paradigm, a16z, Union Square Ventures, SV Angel (backers of Uniswap Labs)

Category: DeFi, AMM Protocol, Decentralized Exchange (DEX)

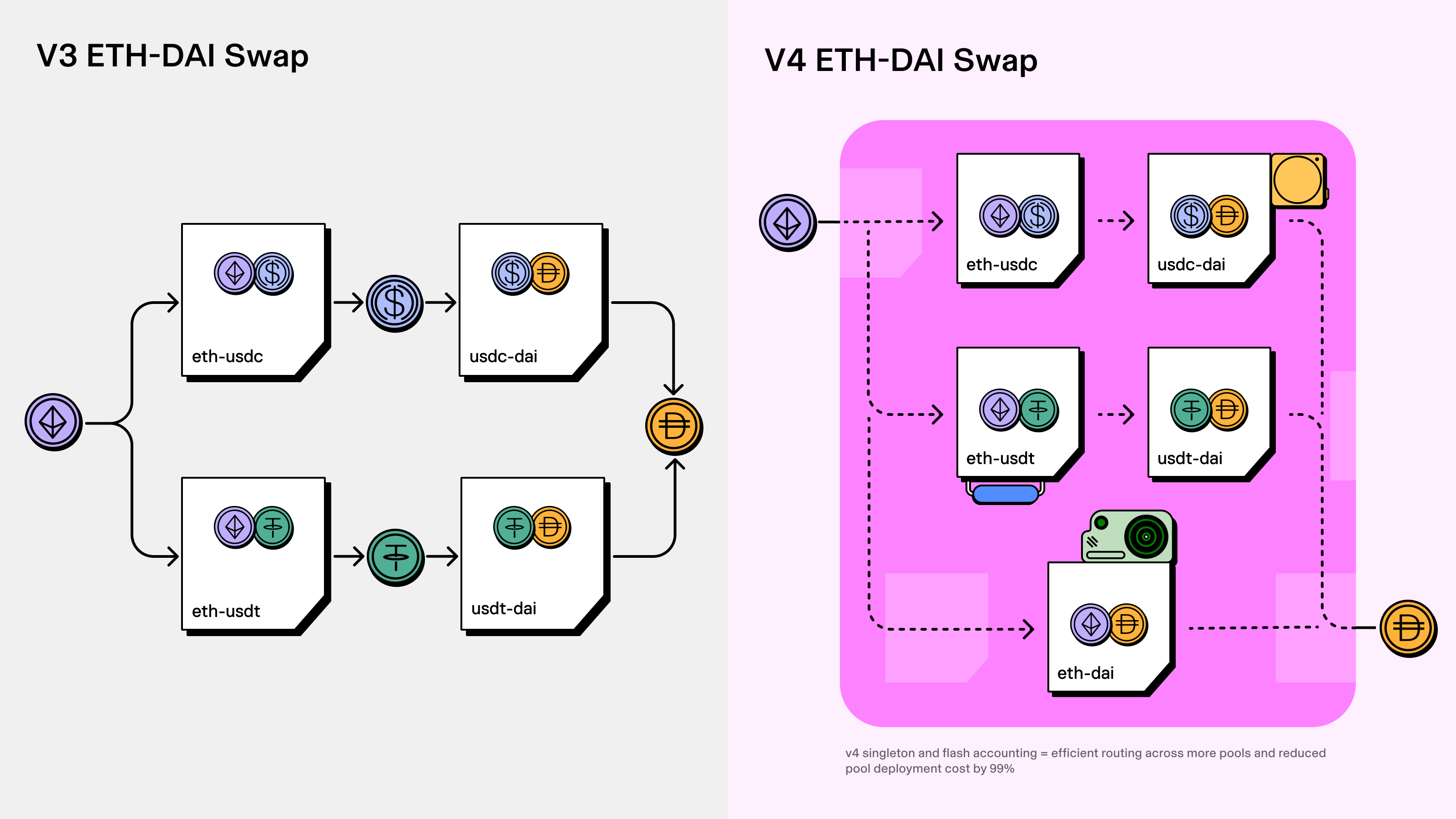

Key Features / Tech Highlights: Hooks for custom pool logic, Singleton Architecture, Flash Accounting, Donated Fees, Native ETH support, variable fee tiers, improved oracle

Token Info: Ticker: UNI, Utility: Governance token for the Uniswap protocol

Uniswap V4 represents a significant evolution in Automated Market Maker (AMM) protocols, promising unparalleled flexibility and capital efficiency within the decentralized finance (DeFi) ecosystem. With the introduction of “hooks,” V4 empowers developers to implement custom logic at various points in the trading lifecycle, from before a swap to after liquidity changes. This modularity unlocks a new frontier for innovation, allowing for highly tailored AMM pools, on-chain limit orders, dynamic fees, and sophisticated liquidity management strategies. By offering greater control and programmability, Uniswap V4 is set to transform how liquidity is provided and utilized, paving the way for more diverse and efficient financial products on Ethereum.

As the Web3 landscape continues to expand, projects are seeking reliable ways to grow, connect with their audiences, and drive sustainable adoption. This is where platforms like Web3Lead play a transformative role. Web3Lead is a powerful user-growth platform built specifically for Web3 and crypto projects. It gives you access to over 400 million social profiles and 1.2 million Web3/crypto communities, enabling deep insights into user behavior and trends. With its analytics tools, you can monitor and segment communities, identify high-potential users, and predict emerging trends. Their user-growth engine helps you acquire real users by providing contactable data like email, phone, and social profiles. Web3Lead supports data-driven growth strategies, helping Web3 projects scale efficiently and sustainably.

For innovators building custom hooks or deploying novel AMM strategies on Uniswap V4, attracting the right liquidity providers and traders is crucial for success. The enhanced customization of V4 means more specialized pools and services, each requiring a targeted audience that understands and values its unique features. Without effective user acquisition, even the most ingenious V4 implementations might struggle to gain traction in a crowded DeFi market.

Leveraging a platform like Web3Lead offers these projects a distinct advantage. Imagine launching a V4 pool with dynamic fees tailored for specific asset classes or a custom hook that enables on-chain automated strategies. Identifying and reaching the exact demographic of sophisticated LPs or arbitrageurs who would benefit most from these innovations is essential. Web3Lead’s granular community insights and user data empower projects to precisely target these high-value users, ensuring that new V4 features are discovered, adopted, and generate significant activity from day one. This proactive approach to user growth can significantly accelerate the path from concept to widespread utility within the Uniswap V4 ecosystem.