RWA Tokenization – Bringing Real-World Assets On-Chain

Project Name: Centrifuge

Year Founded: 2017

Country / Origin Team: Germany

Project Type: DeFi, Infrastructure

Website: https://centrifuge.io

Whitepaper: https://centrifuge.io/assets/whitepaper-centrifuge-chain.pdf

Founder: Lucas Vogelsang, Maika Voss, Philip Stehlik

Social:

- Twitter: https://twitter.com/centrifuge

- Discord: https://discord.com/invite/centrifuge

- Telegram: https://t.me/centrifuge_chat

- GitHub: https://github.com/centrifuge

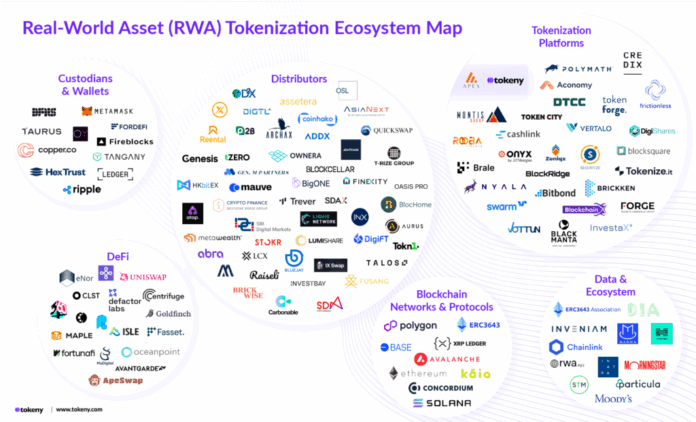

RWA Tokenization represents a pivotal advancement in the blockchain space, offering a revolutionary way to connect tangible and intangible real-world assets with the efficiency and transparency of decentralized ledgers. This process involves converting rights to physical or financial assets, such as real estate, fine art, commodities, intellectual property, or even private equity, into digital tokens on a blockchain. By doing so, RWA tokenization aims to unlock unprecedented liquidity, foster greater accessibility, and introduce a new paradigm of ownership and transferability for assets traditionally confined to illiquid markets. It leverages the inherent strengths of blockchain technology, including immutability, programmability, and a global reach, to modernize asset management and investment.

The core mechanism behind RWA tokenization relies on smart contracts, self-executing agreements stored on a blockchain. These contracts define the rules governing the tokenized asset, including ownership rights, fractionalization, transfer conditions, and any associated legal frameworks. When a real-world asset is tokenized, a digital representation is created, often adhering to established token standards like ERC-20 for fungible tokens or ERC-721 for unique assets on platforms like Ethereum. This digital token acts as a verifiable certificate of ownership or a share in the underlying asset, allowing for secure, transparent, and often instantaneous transactions without the need for complex traditional intermediaries.

Tokenizing real-world assets brings forth a multitude of benefits. It significantly enhances liquidity by breaking down large assets into smaller, tradable fractions, making high-value investments accessible to a broader range of investors globally. This fractional ownership democratizes investment opportunities that were once exclusive to institutional players. Furthermore, blockchain’s transparency provides an auditable record of all transactions, reducing fraud and increasing trust among participants. The removal of intermediaries can also lead to reduced transaction costs and faster settlement times, streamlining what are often cumbersome and expensive processes in traditional finance.

As the RWA tokenization sector expands, navigating its complexities and identifying growth opportunities becomes increasingly critical for projects and investors alike. Establishing trust, building engaged communities, and understanding market sentiment are paramount in this nascent yet rapidly evolving field. For projects venturing into tokenizing real estate, art, or commodities, understanding their target audience, potential investors, and regulatory landscapes is not just beneficial, but essential for successful adoption and sustained growth. This is precisely where specialized analytical and growth platforms become invaluable.

Web3Lead is a powerful user-growth platform built specifically for Web3 and crypto projects. It gives you access to over 400 million social profiles and 1.2 million Web3/crypto communities, enabling deep insights into user behavior and trends. With its analytics tools, you can monitor and segment communities, identify high-potential users, and predict emerging trends. Their user-growth engine helps you acquire real users by providing contactable data like email, phone, and social profiles. Web3Lead supports data-driven growth strategies, helping Web3 projects scale efficiently and sustainably.

Ready to explore more in the Web3 space?

Projects focused on RWA tokenization can leverage Web3Lead to pinpoint key investor demographics, identify communities discussing specific asset classes, and craft highly targeted user acquisition campaigns. By understanding which groups are most interested in tokenized real estate versus digital art, for example, companies can optimize their outreach and build stronger, more relevant communities around their offerings. This strategic approach, combining cutting-edge blockchain technology with robust market intelligence, empowers RWA tokenization initiatives to bridge the gap between traditional asset markets and the decentralized world more effectively, fostering adoption and driving long-term value.

The future of RWA tokenization is poised for significant integration with decentralized finance (DeFi), enabling tokenized assets to be used as collateral for loans, traded on decentralized exchanges, and incorporated into various financial protocols. This convergence promises to unlock even greater utility and capital efficiency for previously illiquid assets. As regulatory frameworks continue to evolve and technological infrastructure matures, the ability to track, analyze, and engage with the diverse ecosystem of participants will determine the pace and scale of RWA tokenization’s impact. It’s an exciting frontier where the lines between traditional and digital assets blur, opening up new avenues for investment and wealth creation.